For financial leaders in the Caribbean, the global conversation around Artificial Intelligence often feels disconnected from regional realities. While headlines tout revolutionary breakthroughs, the practical questions of implementation, compliance, and return on investment remain front and centre. The pressure to innovate is undeniable, yet the path forward is obscured by a complex web of risks, regulatory uncertainty, and the high cost of getting it wrong. This article provides a pragmatic guide for Caribbean banking executives on how to cut through the noise, build a strategy that is both ambitious and achievable, and turn the AI challenge into a distinct competitive advantage.

Navigating the Dual Challenge: Innovation and Compliance

Despite the immense potential, senior leaders are right to be cautious. The adoption of AI introduces a new frontier of risks that must be managed with foresight and diligence. The core challenges extend beyond technology and are deeply intertwined with governance, ethics, and trust. These include:

Algorithmic Bias: The risk of AI models perpetuating or even amplifying existing biases in lending, credit scoring, and other critical decisions.

Lack of Explainability: The “black box” problem, where the inner workings of complex models are not easily understood, making it difficult to justify decisions to customers and regulators.

Data Sovereignty and Privacy: Ensuring that sensitive customer data is managed in compliance with local and international regulations, especially when using cloud-based AI platforms.

The regulatory landscape in the Caribbean is also in a state of dynamic evolution. While specific AI legislation is still emerging, regulators are becoming increasingly proactive. The formation of an AI Task Force in Jamaica signals a clear intent to establish a framework for responsible AI adoption. In parallel, Caribbean institutions operate within a global regulatory and commercial environment and are increasingly expected to align with international standards such as the EU’s AI Act, the NIST AI Risk Management Framework, and ISO 42001 to maintain the trust of international partners and investors.

This dual challenge of fostering innovation while ensuring compliance can seem daunting. However, the solution lies in adopting a proactive and agile approach to governance; one that is embedded into the AI lifecycle from the very beginning.

A Strategic Framework for Responsible AI Adoption

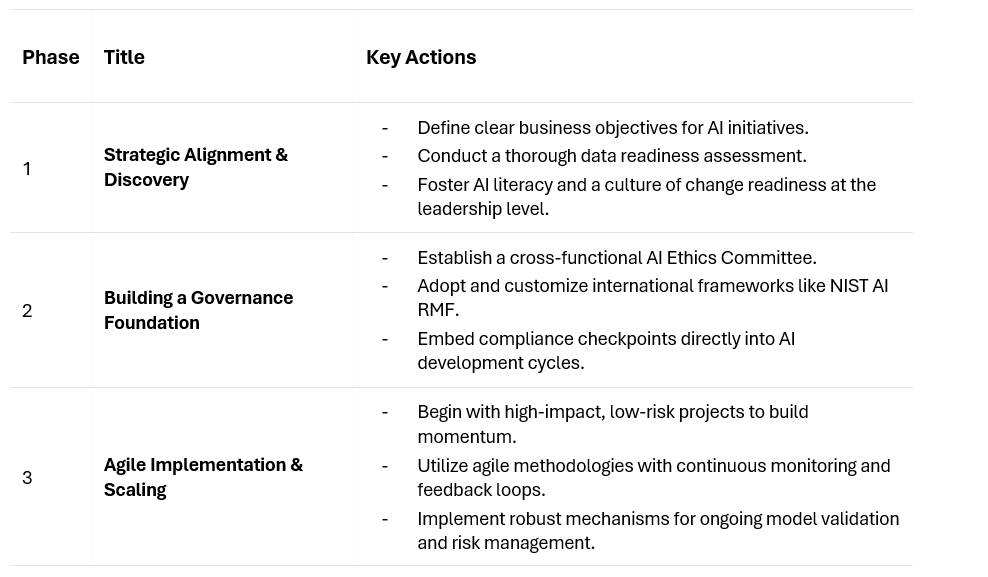

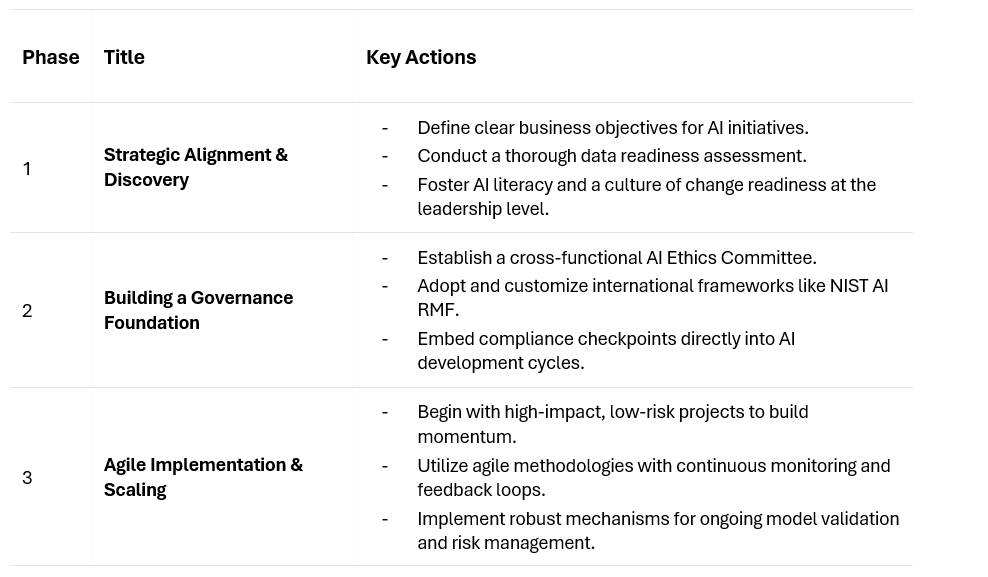

To move forward with confidence, Caribbean financial leaders need a clear, actionable roadmap. The following three-phase framework provides a structured approach to harnessing the power of AI responsibly and effectively.

This framework serves as a continuous cycle of improvement, one that enables institutions to start small, learn fast, and scale their AI initiatives in a way that is both ambitious and responsible.

This framework serves as a continuous cycle of improvement, one that enables institutions to start small, learn fast, and scale their AI initiatives in a way that is both ambitious and responsible.

The New Competitive Advantage: Governance as a Differentiator

As intelligent finance continues to mature, robust AI governance has emerged as a critical source of competitive advantage. Institutions that demonstrate a commitment to trustworthy and ethical AI build deeper trust with customers, foster stronger relationships with regulators, and unlock new opportunities in the global market.

For the Caribbean’s burgeoning Business Process Outsourcing (BPO) and shared services sector, a demonstrable AI assurance capability can be a decisive factor in winning international contracts. By aligning with global standards and proving that their AI systems are fair, transparent, and secure, Caribbean firms can position themselves as premium partners in the digital economy.

The Call to Action: Lead the Transformation

The era of intelligent finance is here. For Caribbean financial leaders, this is a call to action. The journey to AI-driven transformation requires more than just technology; it demands a new mindset, a commitment to lifelong learning, and a culture of responsible innovation. By embracing a strategic approach that places governance and ethics at the core of their AI initiatives, the region’s financial institutions can navigate the challenges and seize the immense opportunities that lie ahead.

The time to act is now. The institutions that will lead the Caribbean’s financial future will be those that treat AI not as a tool to be deployed, but as a transformation to be guided with clarity, competence, and care.

-(5).png)

This framework serves as a continuous cycle of improvement, one that enables institutions to start small, learn fast, and scale their AI initiatives in a way that is both ambitious and responsible.

This framework serves as a continuous cycle of improvement, one that enables institutions to start small, learn fast, and scale their AI initiatives in a way that is both ambitious and responsible.